AML for RMLOs

Length of Course: 40-50 min

Platform: Accessible from any device with seamless progress tracking

Course Outline

Under the Bank Secrecy Act, the U.S. Treasury Department has established stringent AML protocols that apply to Residential Mortgage Loan Originators (RMLOs). These protocols emphasize the development and implementation of comprehensive compliance training programs specifically designed to address money laundering and fraud prevention.

Learning Objectives

- Understand AML Regulations, including the Bank Secrecy Act, Countering the Financing of Terrorism, and the new FinCEN Final Rule on residential real estate transparency.

- Recognize how money laundering occurs, including placement, layering, and integration, with a focus on risks in the RMLO industry.

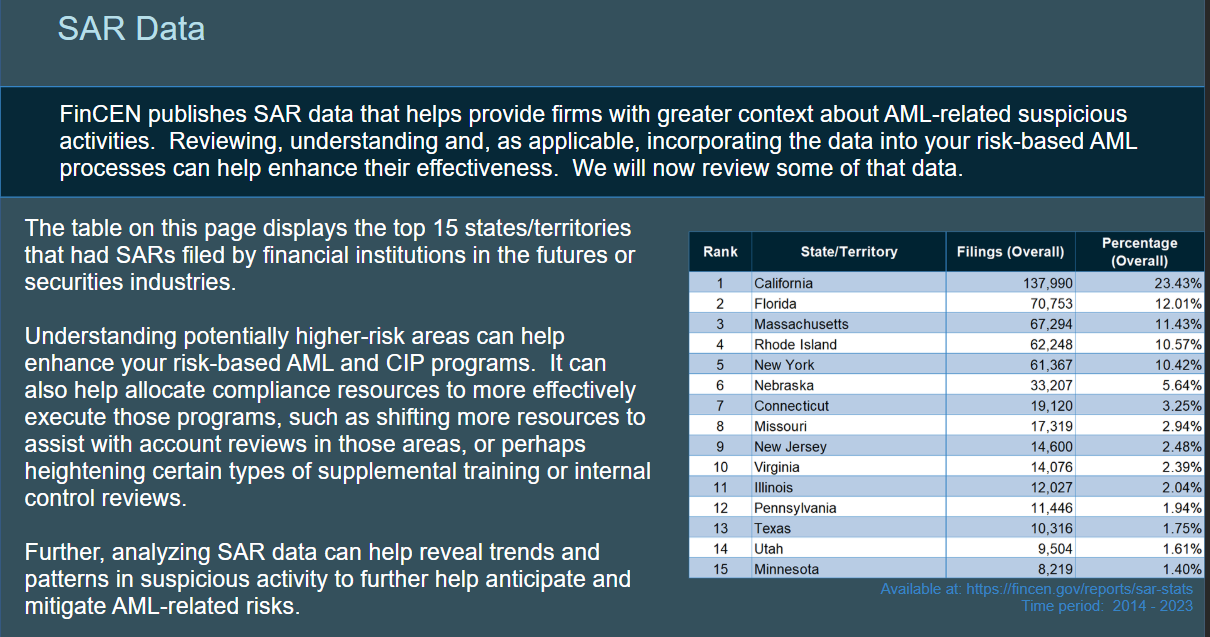

- Apply AML compliance program requirements, including customer identification, suspicious activity reporting (SARs), and sanctions compliance.

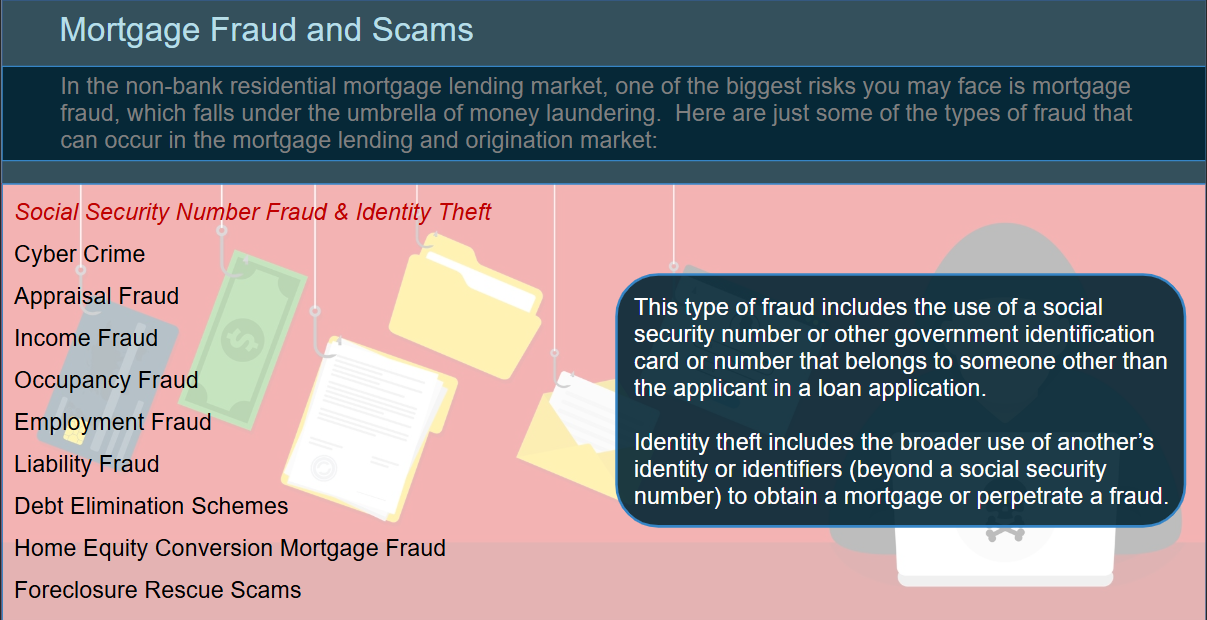

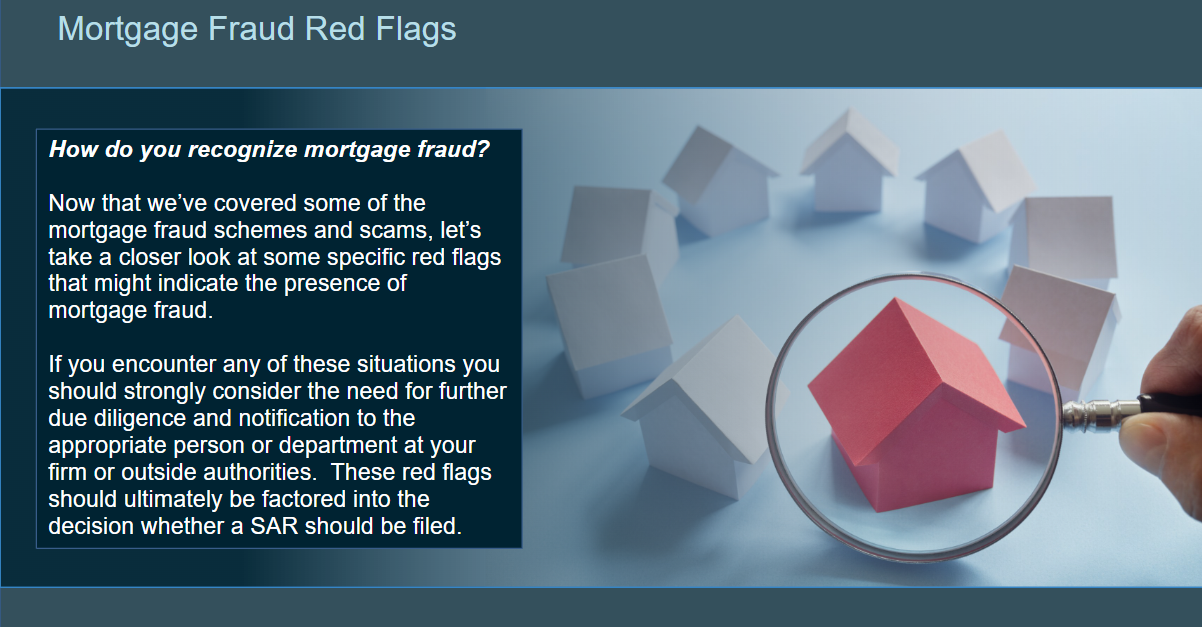

- Recognize Red Flags and suspicious activity in financial transactions, mortgage fraud, and digital asset use.

- Evaluate new AML challenges, including FinCEN alerts on deepfake media, virtual currency scams (“pig butchering”), and elder financial exploitation.

Trusted by

Industry Giants

Course Content

Administrative Advantages

- Dedicated Management Portal: A separate secure login designed specifically for management.

- Real-time Tracking: Instant access to view individual employee progress and completion status.

- Reporting Access: Download certificates and reports including information about training progress, courses, system log, and much more.

- Single Sign-On (SSO) Access: Available for streamlined login, including integration with Okta.

Why Our Clients Choose Us

First-Class

Customer Service

“Team’s commitment to swift and personalized communication sets them apart.”

User-Friendly

Training Portal

“Ease of Learning Management System.”

Compliance Officer

Empowerment

“Ability for CO’s to log in and view employee training status.”

Current and Comprehensive

Content

“Regularly updated course material.”

Individual Learner

Register as an individual user & pay by credit card.

Purchase For Your Firm

Register employees for training. Email orders@xanalytics.com or contact us.